The Taiwanese Gambit

A digitally generated image of the TSMC Headquarters

AI and semiconductors - the craze of the 21st century, especially as we approach a new age of digitalization. Behind this growth are markets that centralize themselves around the process of it, and Taiwan is often overlooked. Who could have known that such a geographically small nation could account for most of the growth in technology? With their expertise in building state-of-the-art hardware, it comes as no surprise that Taiwan houses some of the most efficient foundries and practices for all things IT and semiconductors.

But being a powerhouse is never enough. An economy must hold leverage over all other industries and act as a global market checkpoint. The Taiwanese multinational, TSMC, does this extremely well. It isn’t just another exporter for semiconductors - it pioneers, engineers, and modernizes the ability for ‘Big Techs’ such as Nvidia and even Samsung to thrive within the world of technology.

Given Taiwan's role as the backbone of the semiconductor industry, it is paramount for us, as economists, to understand its importance in this ‘Game of Tech’. In this article, we’ll dive deep into their significance by analyzing market structures, financials, macroeconomics, and geopolitics to conclusively theorize the viability of investing in the Taiwanese economy in the foreseeable future.

Inside Taiwan’s Semiconductor Machine

Within an integrated circuit’s value chain lies one of its most critical segments: the foundry. Unlike software and design, foundries can’t be scaled easily, which is why they require significant upfront capital expenditure. In 2024, Taiwan’s exports to the US accounted for nearly 30% of total exports to the US's key importers (The Economist, Dec. 2025). This stems from the sheer amount of initial investments toward semiconductors needed by Silicon Valley giants such as Nvidia to produce the necessary equipment to cater to AI demands.

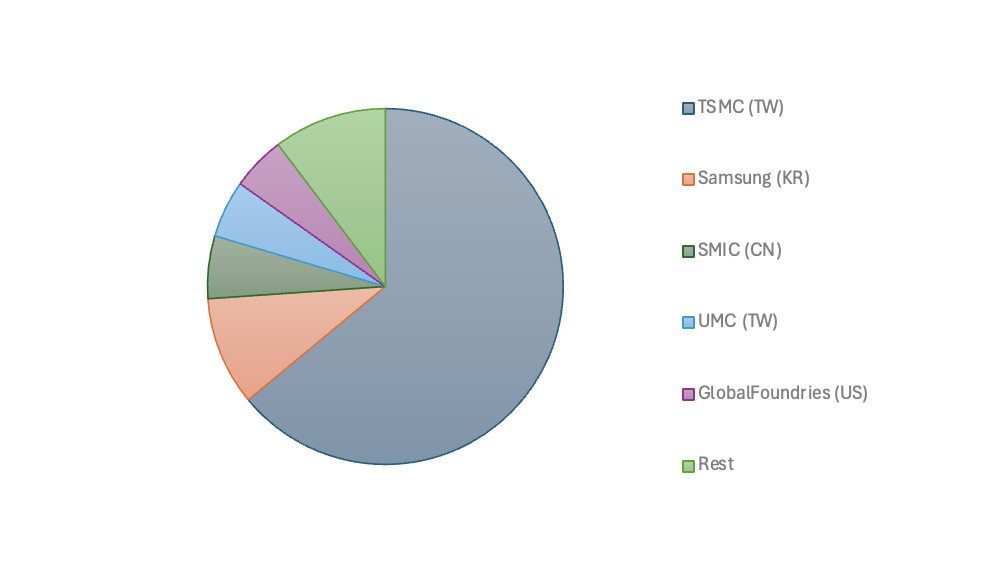

Global Foundry Market Share, (CounterPoint Research, 2025)

In 2024, Taiwanese foundry giants represented nearly 70% of the global foundry share, and with no surprise, TSMC stands on top of this, taking up 64% of the pie. These facts solidify the nation’s position within the global market as an IC chokepoint, further stressing its importance as an exporter to tech companies, and ultimately towards artificial intelligence.

However, dominance within a capital-intensive and geographically fixed industry often concentrates risk, especially when production, logistics, and geopolitics intersect.

Capital, Geography, and Concentrated Exposure

Analysis on firm-level data reflects TSMC’s nature in high investments toward capital-intensive assets. Financials show that roughly 42% of its total assets derive from Plants, Property & Equipment, indicating heavy capital use (2025 TSMC Financial Report). With this, further analysis proves that off-shore plants, such as subsidiaries in the States and Europe, only account for roughly 33.7% of its owned plants, which stresses the fact that TSMC is, indeed, a manufacturing-heavy and geographically-constrained company, ultimately solidifying its dependence on in-shore logistics and production despite its diverse global presence.

TSMC Arizona Manufacturing Facility, 2025

This highlights the main issue surrounding TSMC’s outlook - geographic concentration - which then comes with heightened exposure to risk surrounding politics and disruptions, especially among its neighboring regions, and most notably, its ongoing standoff with China.

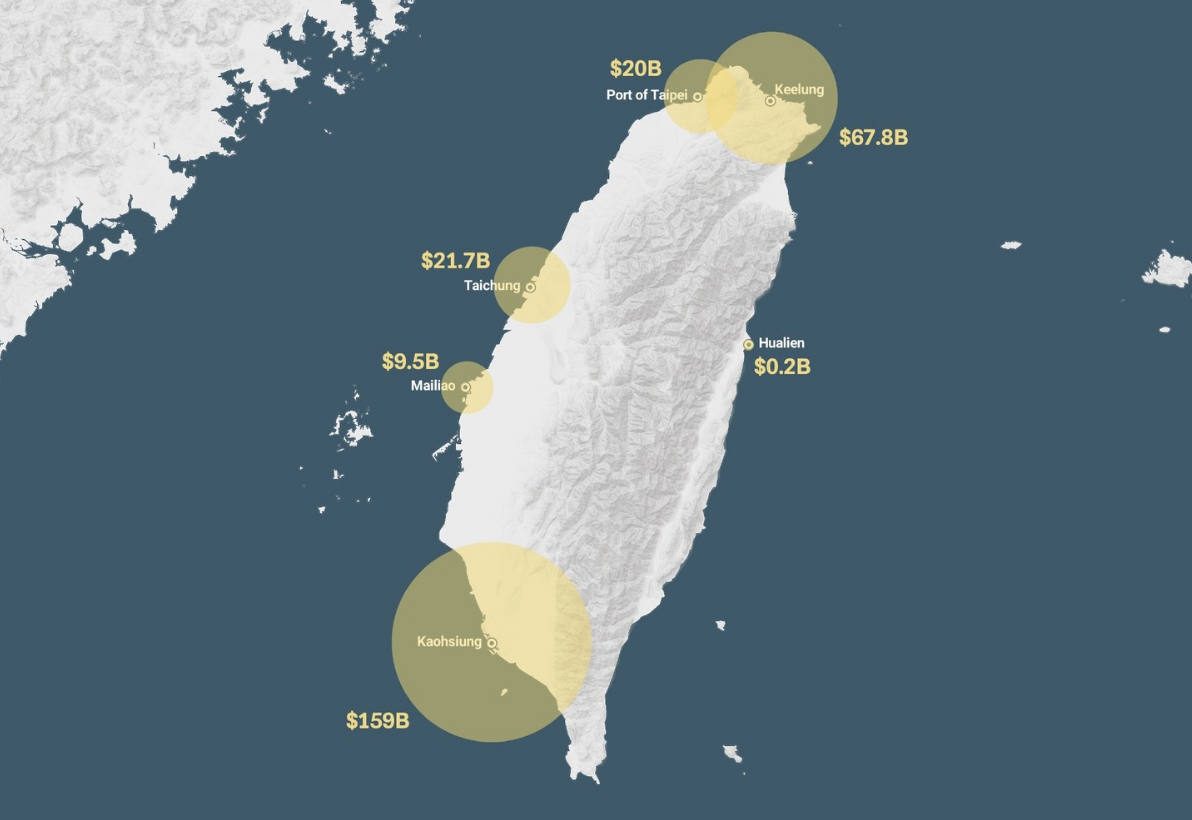

These risks are but theoretical. With military pressures heightened in 2022 following engagements and cooperation with the US, alongside risks of blockades along its west shipping lines, analysts predict that these events may severely disrupt Taiwan’s logistics (Solstad, The Economist). Compounded by this is Taiwan’s geographical constraint. Mountainous terrain along its eastern coast limits its ability to expand its ports beyond what is currently, leaving the island relying heavily on the endangered Taiwanese Strait.

Values of Taiwan’s Major Ports (ChinaPower, 2022)

AI Demand and Taiwan’s Macroeconomy

Now that we’ve painted the picture that TSMC - and ultimately Taiwan- holds significant leverage within the global foundry market, it is necessary for us to shift our viewpoints towards a macroeconomic lens, and understand Taiwan’s role as an AI accelerator in order to bridge our understanding further.

Nvidia Headquarters, 2025

Nvidia is globally recognised as a leading designer of graphics processors and computing hardware, with its most recent growth driver being AI infrastructure. Within this analysis, Nvidia is relevant not as a manufacturer, but as one of TSMC’s largest customers. Given its dominant position in supplying AI accelerators to data centres, Nvidia's revenue figures from its financial statements were used as a proxy for global AI demand, as they reflect the scale and timing of global investment in AI infrastructure. In short, Nvidia’s revenues were selected as they are a high-signal indicator of global AI demand.

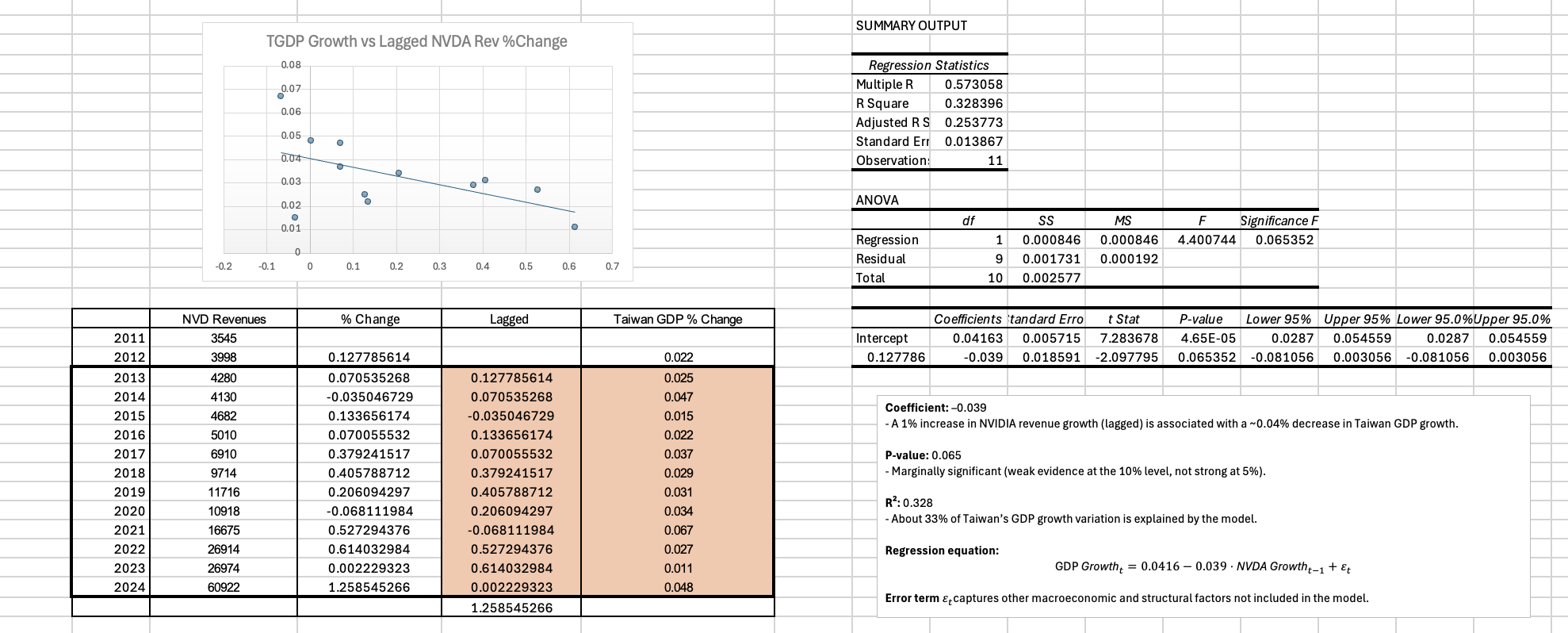

Intuitively, one might expect that stronger global AI growth would translate into a positive, albeit modest, impact on Taiwan’s GDP. However, empirical results from the regression analysis suggest otherwise. After accounting for growth in TSMC’s market share and other error terms, Nvidia’s revenue growth exhibits a weak and negative coefficient when explaining Taiwan’s GDP growth. This result persists even after controlling for lagged effects.

Bonus - Regression Analysis

Simple Regression Analysis - TW GDP vs NVDA Rev.

This inverse relationship highlights a structural disconnect within the IC value chain. While Nvidia captures the bulk of economic rents generated by AI expansion, Taiwan primarily absorbs the capital intensity, capacity constraints, and fixed investment burden associated with semiconductor manufacturing. As a result, the macroeconomic transmission of AI-driven growth into Taiwan’s broader economy remains limited.

Further analysis, however, indicates a strong and positive correlation between TSMC’s growth and Nvidia’s Revenues, further strengthening the Taiwanese foundry’s position within the market as a key player. In simple terms, the standard theory suggesting that Nvidia’s economic gains highly tying to its trades with TSMC is further justified with simple econometrics.

The Gambit

Taken together, Taiwan’s position within the golden age of AI is represented by clear tension. Although they hold a crucial status within the AI supply line, the economic gains from the market are not evenly shared across all parties within the chain.

As Taiwanese foundries make the country more critical to the AI economy, it also concentrates risk in the context of geopolitical tensions and the island’s heavy reliance on the Taiwan Strait for trade.

This is the Taiwanese gambit: A bet that Taiwan’s indispensability will outweigh risks that come with concentration and reduced economic benefits. As economists, it’s hard to argue against the logic of this strategy, but its success ultimately hinges on both global and regional stability.

Knowing this, would you invest in the Taiwanese economy within the foreseeable future?

- Ashraf Zhu, 29/12/2025